Category: real estate

Midwest Real Estate News “Best of the Best” 2020

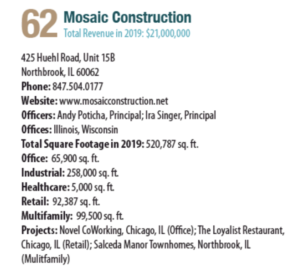

For two decades, Midwest Real Estate News has honored the best the commercial real estate profession has to offer in its annual Best of the Best feature. We are proud to be included as a Top Midwest Construction Company alongside other leading Midwest firms in this year’s 20th edition. You can read the Midwest Real Estate News Best of the Best 2020 here. We are featured on page 34.

Construction On Cannabis Dispensary Begins

Northbrook Patch | Jun 17, 2020 – Construction is underway on a new recreational and medical dispensary at 755 Skokie Blvd. in Northbrook. Cannabis Facility Construction, a national, full-service, cannabis design-build construction firm based in Northbrook, announced the news Tuesday. The facility will be run by Greenhouse Group LLC.

The Northbrook location will be a national flagship location for the brand, according to a press release. The site, offering nearly 10,000-square-feet of finished space, is the former home the Rehabilitation Institute of Chicago. The vacant Marathon Gas station at 430 Dundee Road will be consolidated into one lot.

“As their preferred design-build partner, CFC has delivered multiple dispensaries for Greenhouse over the past five years in various states across the country,” said Andy Poticha, principal at Cannabis Facility Construction, in the release. “We are now especially excited to have this opportunity to build their largest flagship location right here in our own backyard.”

Read more at Northbrook Patch

Stipulated Sum Agreements Make Us the Right Builder for You

Our goal as a design-build firm is to create value for our clients through outstanding service-delivery and building trusted relationships. One of the many ways we achieve our goal is how we structure our contracts. Our clients want to know what they’re paying for, and we are able to clearly spell that out by providing stipulated sum agreements.

What is a Stipulated Sum?

Also referred to as a lump sum contract, a stipulated sum requires a builder to agree to provide specified services for a fixed price based on labor and material costs. The builder is responsible for executing the job properly and will provide its own means and methods to complete the project. Specifically, we use stipulated sum agreements with our multifamily and commercial projects, and they allow us to better define the scope and schedule of projects.

“The Mosaic Construction way is to be a client-first company in which we anticipate needs and focus on relationship-building,” said Singer. “We’ve always led with this approach, and our clients understand the value of that.” – Ira Singer

Why We Use Stipulated Sums

Mosaic Construction uses stipulated sums so that our clients know what they’re getting, and we know exactly what we need to deliver. Our contracts are predictable and easy to manage and benefit our clients in the following ways:

No Hidden Fees

One of Mosaic Construction’s key differentiators is that we never stick our clients with hidden fees, compared to cost-plus-fixed-fee and other contracts. “Our fees are transparent compared to other contractors,” said Ira Singer, Principal of Mosaic Construction on the This is the Real Estate Investing for Cash Flow podcast. “We have no incentive to say, ‘Okay, it’s going to be this much money for cost.’ Stipulated sums are integral in forging trusted relationships with our clients.”

Predictability

Our clients value the predictability of stipulated sum agreements, especially since they reduce risk and give them more confidence. With an agreed upon sum in place, our clients are not liable for any cost overruns. “We formulate construction based on our time and our investment to manage that project and steward it,” added Singer. “Whatever the cost of the project, our timeframe for completion and our fees will remain the same. In this respect, both parties are incentivized to stay on schedule and finish the job on time.”

Better Collaboration

We find that stipulated sum arrangements foster a greater degree of collaboration between Mosaic Construction and our clients. We are able to execute tight project management and more efficient communication to ensure that both parties are adhering to the scope of work. “The Mosaic Construction way is to be a client-first company in which we anticipate needs and focus on relationship-building,” said Singer. “We’ve always led with this approach, and our clients understand the value of that.”

The design-build methodology supports our goal because it allows us to streamline the construction process, which ultimately benefits our clients and our management team. “We view our projects as investments in our clients’ growth and development,” added Singer. “We never think in terms of being one and done; rather, we create an atmosphere where our clients can focus on business development, while we do the best work possible for them.”

2019 Multifamily Outlook

As we previously reported, 2018 was a banner year for multifamily housing, with a 44% increase in sales accounting for more than 30% of the total U.S. real estate investment sales. What is the health of the 2019 multifamily housing market through the first two quarters, and where will it go from here? Freddie Mac has answered these questions and more in its Multifamily 2019 Midyear Outlook. Overall, the outlook is positive, showing signs of sustainability and growth for the remainder of the year and beyond.

According to Freddie Mac, “In our research, we find that strong economic growth and the robust labor market continue to support the strength in the multifamily market. Last year ended much stronger than anticipated with near record absorptions and stronger rent growth compared with the prior few years. The first two quarters of 2019 saw mixed results, with slower growth in the first quarter, but preliminary second quarter information indicating the spring leasing season is off to a strong start. Along with the strong fundamentals, lower interest rates continue to drive origination volume higher throughout 2019.”

Low Unemployment is Having a Favorable Impact

It is anticipated that the labor market–with low unemployment and wage growth–will continue to drive housing demand, benefiting multi-family properties. As the report states, “Pending any broader economic event that would impact the labor market, there is no real estate specific headwind on the horizon that could disrupt the favorable outlook for multifamily through the rest of this year and into the next.”

Loans Increase While Absorptions Dip

Multifamily originations–or fees associated with processing a loan–are continuing their upward trend from 2018 through the first two quarters of 2019. Originations have increased by 8% to $336 billion. “The 10-year Treasury reached 1.75%, a decline of 150 bps (basis points) from last November,” the report says. “Rate declines generally drive origination volume higher, and with a drop of this magnitude to very low levels, forecasts must be decisively higher than earlier in the year.”

Absorption rates, by contrast, saw strong gains in 2018 only to stall thus far in 2019. “The first quarter of 2019 saw absorptions wane and high levels of new supply entered the market, but strong gains in the second quarter suggests the trends for multifamily are not yet turning.”

“In our research, we find that strong economic growth and the robust labor market continue to support the strength in the multifamily market.”

– Freddie Mac

Higher Demand and Lower Supply

Multifamily demand is outpacing new supply, as there is a shortage of housing compared to households. Total housing completions over the past three years have averaged 1.1 million housing units each year, while the number of households have increased on average 1.4 million. Per the report, “The continued increase in multifamily construction when the overall housing market continues to remain unbalanced is not necessarily an oversupply concern as the economy struggles to build enough housing.”

Steady Growth Ahead

The multifamily market is bright. Freddie Mac projects overall growth for the remainder of 2019 and into 2020 with high-demand spurring on new construction. “As this supply enters the market, we expect vacancy rates to increase throughout the year, but only marginally, up to 5.2%. We anticipate that rent growth will remain healthy at around 4% in 2019.”

Home-Sharing is Creating Value for Multifamily Property Managers

Home-sharing is a multi-billion dollar industry that is gaining momentum with unlikely allies: multifamily property managers. Traditionally, multifamily property managers have made cash off long-term leases and rent costs and prohibited home-sharing because they violated rules and regulations. But a report from the National Multifamily Housing Council (NMHC) estimated that about 65% of recent Airbnb bookings were in multifamily buildings, including apartments, condos and even in-development hotels. It also found that 43% of property managers have had short-term rentals occur without their approval. To legitimately meet the home-sharing demand, companies are bringing their innovations to multifamily property managers. Apartments Doubling as Hotels

Among the operational challenges that multifamily managers encounter is what to do during dry leasing periods. Enter companies like WhyHotel and Stay Alfred that take un-leased apartments and convert them into furnished, amenitized hotel units. This pop-up hotel model has been gaining traction. Zak Schwarzman, an investor in WhyHotel, told Forbes, “It’s no surprise that companies in this category with a clear value prop are receiving a warm reception from the multifamily community. WhyHotel offers developers significant newfound revenue by managing their yet-to-be-rented inventory as short-term hospitality during a building’s lease-up period. Who would say no to that?”

Stay Alfred focuses on market rate properties, providing a more upscale, short-term hospitality experience. In addition to furnishing empty units, the company rents them and staffs the buildings. Legitimate Short-Term Rentals

To eliminate the notion of black market short-term rentals, multifamily managers are taking a proactive approach to the leasee-turns-landlord problem. YOTELPAD in Miami became the first condo community to permit restriction-free short-term rentals. David Arditi, founding principal of Aria Development Group, the developer of YOTELPAD, told Forbes, “We’ve heard many stories of residential buildings having to deal with owners who are trying to skirt local legislation by renting out their units on a short-term basis. They are typically not allowed to do so given condominium association and zoning restrictions. We thought, why not do something that addresses this head on and gives people the option to do what they are asking for?”

Making life easier for multifamily property managers are companies like San Francisco-based Pillow, which provides the tools for property managers to control all short-term rental hosting in their buildings, as well as share in the revenue, ensure local regulatory compliance, and insure against damage.

NMHC/NAA Support

Multifamily home-sharing has the support of NMHC and the National Apartment Association, two of the most influential industry and advocacy organizations. “NMHC/NAA support the right of multifamily firms and other property owners to participate in all aspects of the sharing economy, if they so choose, and if it is done in full compliance with existing law and regulations,” according to an NMHC home-sharing fact sheet. The fact sheet emphasizes that the choice is ultimately up to multifamily property owners, but it encourages the practice as it creates additional revenue streams. “Policymakers at all levels wanting to regulate the short-term rental market should be cautious as to not inhibit the benefits of the sharing economy, while ensuring that the protection of private property rights and contractual obligations between property owners and residents are respected.”

What’s Next?

Multifamily home-sharing is more than a trend and will seemingly continue to evolve. We previously covered Airbnb’s entrée into the multifamily property manager partnership with its Niido brand, which launched its flagship property in Orlando. The program has been so successful that the company is expanding into Nashville with plans to open up to 14 more properties by 2020. This combined with the momentum of short-term rentals positions the home-sharing model to generate more cash and lower operational costs to reduced unit turnover and improved brand awareness for multifamily property managers.

Real Estate Investing for Cash Flow – Kevin Bupp Podcast with Ira Singer

Expanding a Successful Construction Company from the Culture Up – with Ira Singer

Speaker 1: You’ve been searching for the best way to generate passive income in your life, and heard that real estate is a great way to do it. But you’re tired of all the so-called gurus, who are all talk and no substance. Get ready to celebrate because Kevin Bupp has spent 14 years successfully making it happen.

This is the Real Estate Investing for Cash Flow podcast. Now, here’s Kevin Bupp.

Kevin Bupp: Hey, guys. Kevin Bupp here. I want to welcome you to another episode of the Real Estate Investing for Cash Flow podcast. Our mission is to help you build and maintain massive amounts of cash flow through income-producing real estate investments. Now, our guest for this week’s show is real estate investment and construction expert, Ira Singer. Ira has been a principal of Mosaic Construction since 2005 and currently leads new business development, estimating, construction production, project management, and the management of trade partner and vendor relationships for Mosaic Construction.

Kevin Bupp: Guys, now, without further ado, I’d like to welcome our guest for today’s show, Ira Singer. Ira, how are you doing today my friend?

Ira Singer: Kevin, doing great. Thank you. Appreciate time on the phone and the introduction, so I’m looking forward to the conversation.

Kevin Bupp: Yeah. Looking forward to having you here. You bring a breath of knowledge and experience on the construction trade to this call, which is … Your expertise is one that we haven’t necessarily had on the show before. It’s interesting because we’re going to take it from a little bit of a different angle today. We interview many different investors that specialize in different types of asset types. We’ve had, I don’t know, probably 100 multifamily guys on the show over the years. We’ve had retail guys, office guys, student housing guys, senior housing guys on the show, and gals. I shouldn’t just say guys. Guys and gals that are in the investment side of the space.

Kevin Bupp: Well, those folks are basically your clients. They hire your team, your construction firm, which is on a national scale, to help them with their projects. Whether it be rent large scale renovation projects, new builds and probably everything in between. Real excited to take it from this perspective and dive into your business and what it is you guys do over there at Mosaic. But before we do, Ira, maybe if you could take a few minutes. I gave you a very brief introduction. Your background’s much more extensive than that. Take a few minutes and tell our listeners a little bit more about yourself and really how you got started in this business.

Ira Singer: I’d be happy to. All of those different asset class owners are potential clients for Mosaic Construction. We’ve had a breadth of experience that didn’t start that way.

Ira Singer: I was in the window business, straight out of school in 1990. In 1993, I started my first window, siding, roofing company that was catering to homeowners. Was successful at that, had a partner in that. Learned trade by residential work. Going in and picking up clients one at a time. That led to some business introductions of real estate owners. A couple of years into business we were working on multifamily construction doing window replacements on a large scale basis, 300, 500, 600 windows, either vinyl or aluminum.

Ira Singer: That, of course, continued into interior renovation work because while we’re there, a trusted contractor, which is an important component of an investment in real estate, to have a trusted GC. They ask the question. They’re happy with our window work, so we got started on doing all kinds of different makeovers, and all kinds of different multifamily projects. Whether it was senior housing, and it was in units, or whether it was market rate apartments in with amenity spaces, or common area spaces. The senior housing market is all about safety and accessibility. There’s all kinds of different value adds and different projects that we’ve been involved in.

Continue reading “Real Estate Investing for Cash Flow – Kevin Bupp Podcast with Ira Singer”